May 2021 –

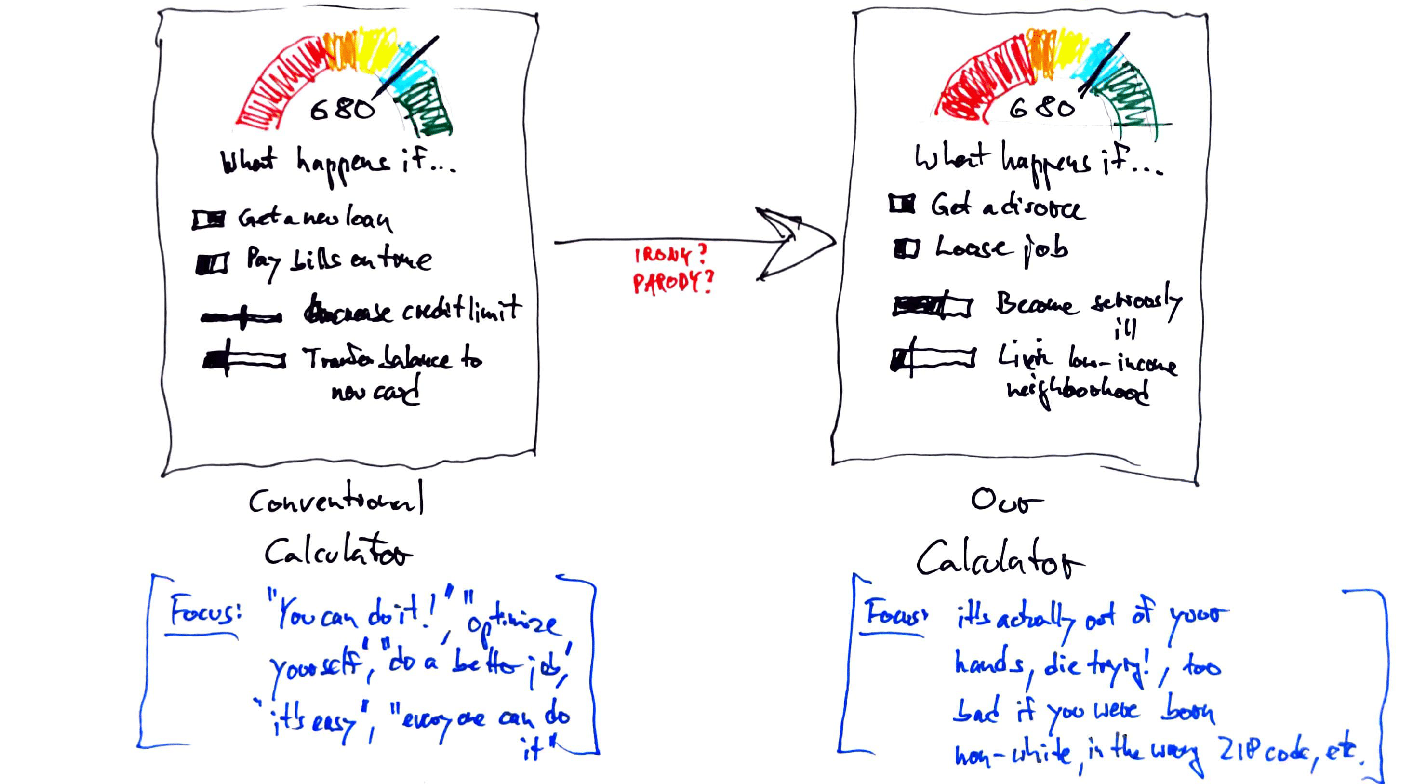

In the world of consumer finance, credit score simulators are a common feature offered by a range of companies and websites. Often touted as a tool for learning and financial literacy, these simulators allow users to experiment with different scoring factors to see how these affect their scores. Examples of such simulators can be found on websites like TransUnion, FICO, American Express, and Credit Karma.

One problem with these simulators is that they cast credit scoring in a rather unrealistic light. Among other things, they suggest a degree of transparency about the scoring process that does not hold in practice; they create an illusion of individual control that does not exist; and they generate an image of a system that is worth investing time and resources in although these actions are not guaranteed to have results. In other words, these systems do not just simulate a score, they simulate a world in which scoring appears to be a rational and sensible solution.

In this project, we re-appropriate the interactive form of the credit score simulator in order to make visible the “hidden” scoring factors and assumptions built into the system. Rather than focusing on the official factors such as lines of credit, credit utilization ratios, and on-time payments, we construct an alternative scoring model based on research that takes into account those features usually externalized. Variables like wealth, gender, and ZIP code, for example, have been shown to be important factors influencing credit scores. So why not build a simulator based on these ideas and include them in the calculation?

Funding: NSF CAREER Award (#1848286)

Researchers:

Michael Tyrrell

Summer Research Fellow